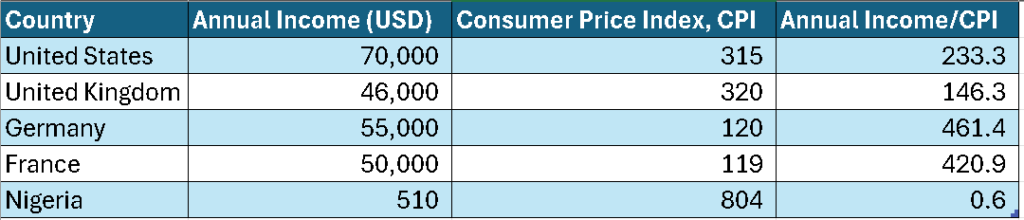

The data comparing income levels and the Consumer Price Index (CPI) across five countries highlights the severe economic stress that Nigerians are currently experiencing.

While developed countries like the United States, United Kingdom, Germany, and France face high costs of living, their relatively high incomes allow their citizens to maintain a decent standard of living. In stark contrast, Nigeria’s crippling combination of low income and skyrocketing inflation has left its citizens in an untenable financial situation.

Understanding the Income-to-CPI Ratio: A Global Comparison

When analyzing the provided data, a pattern emerges among developed nations: despite varying levels of inflation, their income-to-CPI ratios are high enough to cushion the impact of rising prices. This ratio represents how well citizens can afford their cost of living. A higher ratio suggests that people can manage expenses, even in an inflationary environment.

- United States: With an annual income of $70,000 and a CPI of 315, the income-to-CPI ratio stands at 233.3. This means that Americans have a buffer against inflation—while prices might be high, their income allows them to sustain a comfortable standard of living.

- Germany and France: Both Germany and France show similarly strong ratios, 461.4 and 420.9 respectively. This indicates that citizens in these countries, earning $55,000 and $50,000 annually, have enough financial bandwidth to absorb higher costs of living, even as prices increase.

- United Kingdom: Although slightly lower, the UK’s income-to-CPI ratio of 146.3 still provides a reasonable level of protection against inflation. With a median income of $46,000, the average British citizen can manage their cost of living despite inflationary pressures.

Now, compare this to Nigeria, where the situation is nothing short of disastrous. The income-to-CPI ratio in Nigeria is a mere 0.6, one of the lowest figures imaginable in any nation. With an average income of just $510 and a CPI of 804, the cost of goods and services is completely out of reach for most Nigerians.

The Nigerian Economic Crisis: A Failure of Leadership

Nigeria’s economic catastrophe can largely be attributed to decades of poor governance, corruption, and economic mismanagement by its leadership. This is not a situation driven solely by global economic forces; rather, it is the result of deliberate failures and greed by those in power.

- Staggering Income Disparities: The Nigerian average income of $510 is not only inadequate but also highlights the massive income inequality that has worsened over time. While the elite political class and their cronies enjoy immense wealth—often siphoned off through corrupt means—ordinary Nigerians are left to survive on wages that are nowhere near sufficient to cover basic needs.

- Out-of-Control Inflation: With a CPI of 804, the price of goods and services has skyrocketed, fueled by rampant inflation and a steep decline in the value of the Nigerian naira. Inflation has been driven by a multitude of factors, including poor monetary policies, the devaluation of the currency, and the country’s heavy reliance on imports. Basic necessities like food, housing, healthcare, and transportation have become unaffordable for the average Nigerian.

- Endemic Corruption: One of the most brutal realities of Nigeria’s economic crisis is that much of it stems from corruption at the highest levels of government. Despite being one of the wealthiest nations in Africa in terms of natural resources, particularly oil, the benefits of this wealth never trickle down to the masses. Instead, corrupt leaders enrich themselves while failing to provide the infrastructure, services, and job opportunities that could alleviate the financial suffering of the population.

Why Nigerians Are Suffering

The combination of low income and high prices is a recipe for extreme economic stress. The income-to-CPI ratio of 0.6 means that for every dollar earned, the cost of living is so high that even survival is in jeopardy. This figure starkly contrasts with the figures for developed countries, where income levels are sufficient to accommodate the rising costs of living.

In practical terms, this means that a Nigerian earning $510 per year would find it impossible to afford basic goods and services, while their counterparts in the United States or Germany are far more capable of managing their expenses, even when prices rise.

The Contrast: Developed Nations vs. Nigeria

While countries like the United States, Germany, and France have their own economic challenges, their governments have managed to build systems that protect the majority of their citizens from falling into extreme poverty. Through welfare programs, public services, and functioning institutions, developed countries ensure that a balance exists between income levels and living costs.

This starkly contrasts with Nigeria, where a combination of bad governance, poor economic planning, and rampant corruption has stripped the country of the means to provide for its citizens. The result is an economy where people live in perpetual financial stress, with no hope of relief on the horizon.

Conclusion: The Brutal Reality of Nigeria’s Economic Descent

The data presented paints a bleak picture for Nigeria. With an annual income-to-CPI ratio of 0.6, the country is in an economic freefall, a crisis that is not only unsustainable but immoral. The failure of the government to implement meaningful reforms, tackle corruption, and address inflation has left Nigerians in dire straits.

While people in the United States, Germany, and other developed nations face the reality of higher costs of living, their economies are structured to protect them. In Nigeria, the same cannot be said. Without immediate, radical reforms, the situation will only worsen, and the economic divide will continue to expand, leaving millions trapped in poverty.